First-time homebuyers are flocking to the housing market in greater numbers than any time in the last few years. Renters who are ready and willing to buy are now realizing that they are also able to as well. Many first-time buyers are Millennials (born between 1981 – 1997).

First-time homebuyers are flocking to the housing market in greater numbers than any time in the last few years. Renters who are ready and willing to buy are now realizing that they are also able to as well. Many first-time buyers are Millennials (born between 1981 – 1997).

If you are one of the many in this generation who sees your friends and family diving head first into the real estate market, and wonder if now is the time for you to do the same, keep reading!

The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.

Let’s look at an example of what the experts are predicting for the upcoming year, and what that really would mean for you. Let’s say you’re 30 and your dream house costs $250,000 today. Right now mortgage interest rates are at or about 4%.

Your monthly mortgage payment (principal & interest only) would be $1,193.54.

But you’re busy, you like your apartment, and moving is such a hassle. You decide to wait until next year to buy. CoreLogic predicts that home prices will appreciate by 5.1% in the next 12 months; this means that same house you loved now costs, $262,750.

Freddie Mac predicts that over this same period of time, interest rates will be a full point higher at 5.0%. Your new payment per month is now $1,410.50.

The difference in payment is $216.96 PER MONTH!

That’s basically like taking $8 and tossing it out the window EVERY DAY!

Or you could look at it this way:

- That’s your morning coffee everyday on the way to work (average $2) with $10 left for lunch!

- There goes Friday Sushi Night! ($50 x 4)

- Stressed Out? How about a few deep tissue massages with tip!

- Need a new car? You could get a brand new car for $217 a month.

Let’s look at that number annually! Over the course of your new mortgage at 5.0%, your annual additional cost would be $2,603.52!

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a deck for entertaining. We could come up with 100’s of ways to spend $2,603, and we’re sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $78,105.60, all because when you were 30 you thought moving in 2015 was such a hassle or loved your apartment too much to leave yet.

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready. But if they showed you that you could save $78,000 you’d at least listen to what they had to say.

They say hindsight is 20/20, we’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

![Homeownership Still The American Dream [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/06/American-Dream.jpg)

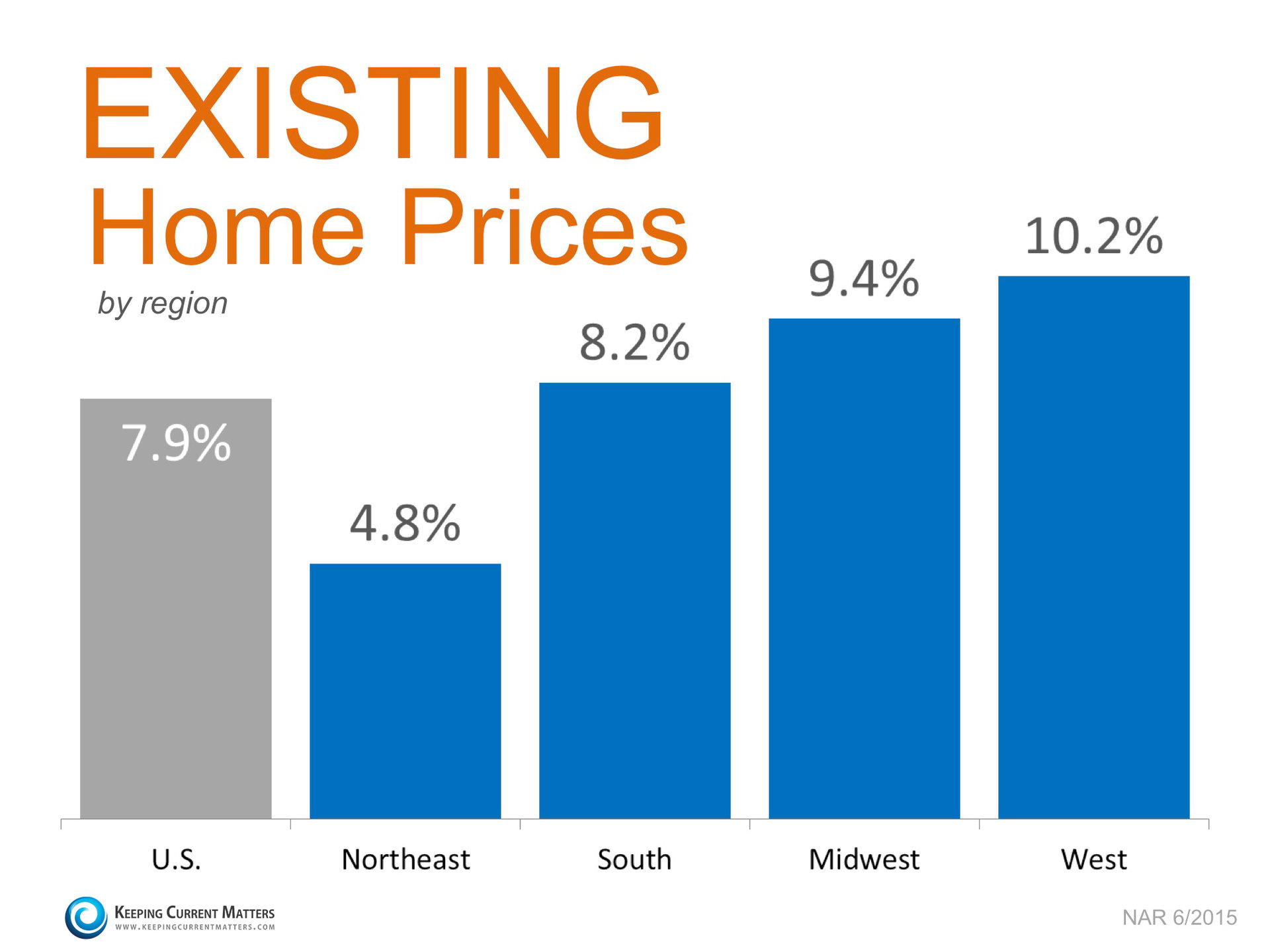

The National Association of Realtors’ (NAR) latest

The National Association of Realtors’ (NAR) latest

The Federal Reserve Bank of New York recently released the

The Federal Reserve Bank of New York recently released the

4816 Sawyer Ave Carpinteria, CA | Offered at $655,000

4816 Sawyer Ave Carpinteria, CA | Offered at $655,000