There has been recent press regarding whether or not it makes better financial sense to rent rather than buy in today’s housing market. As an example, the recently released June Summary of the BH&J Buy vs. Rent Index reported:

“…as of the end of the first quarter of 2015, the housing market in the U.S. and all cities in the index are trending either closer to renting being the superior option or strictly favoring renting over purchasing a home.”

The summary goes on to explain that:

“The index conducts a “horse race” comparison between an individual that is buying a home and an individual that rents a similar quality home and reinvests all monies otherwise invested in homeownership.” (emphasis added)

Though the math may be correct, we are not as sure of the conclusion. Even if you check the methodology offered by the BH&J report itself, you will find that they realize:

“…any extra savings from renting might be spent on non-wealth enhancing goods resulting in any benefits from renting versus owning disappearing in a cloud of consumption spending rather than savings.”

The Concept of ‘Forced Savings’ and Wealth Accumulation

Many believe the wealth accumulation of homeowners is tied into the concept of “forced savings”. The New York Times late last year published an editorial entitled, “Homeownership and Wealth Creation, which discussed this concept. The article explained:

“Homeownership requires potential buyers to save for a down payment, and forces them to continue to save by paying down a portion of the mortgage principal each month.”

“Even in instances where renters have excess cash, saving a substantial amount is difficult without a near-term goal, like a down payment. It is also difficult to systematically invest each month in stocks, bonds or other assets without being compelled to do so.”

Many of the points that were made in the article are on track with the research done by the Joint Center for Housing Studies at Harvard University which agrees that “forced savings” is a major advantage of homeownership. In a paper, The Dream Lives On: the Future of Homeownership in America, they concluded:

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

The Truth is in the Historical Data

Edwards Deming once said: “Without data, you’re just another person with an opinion.”

Let’s look at the data on this subject. The Federal Reserve has conducted a study titled: Survey of Consumer Finances. The study found that the average net worth of a homeowner ($194,500) is 36 times greater than that of a renter ($5,400).

The New York Times editorial articulated it best:

“Homeownership long has been central to Americans’ ability to amass wealth; even with the substantial decline in wealth after the housing bust, the net worth of homeowners over time has significantly outpaced that of renters, who tend as a group to accumulate little if any wealth…As a means to building wealth, there is no practical substitute for homeownership.”

4311 Carpinteria Avenue, Carpinteria CA 93013

4311 Carpinteria Avenue, Carpinteria CA 93013

![Homeownership Still The American Dream [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/06/American-Dream.jpg)

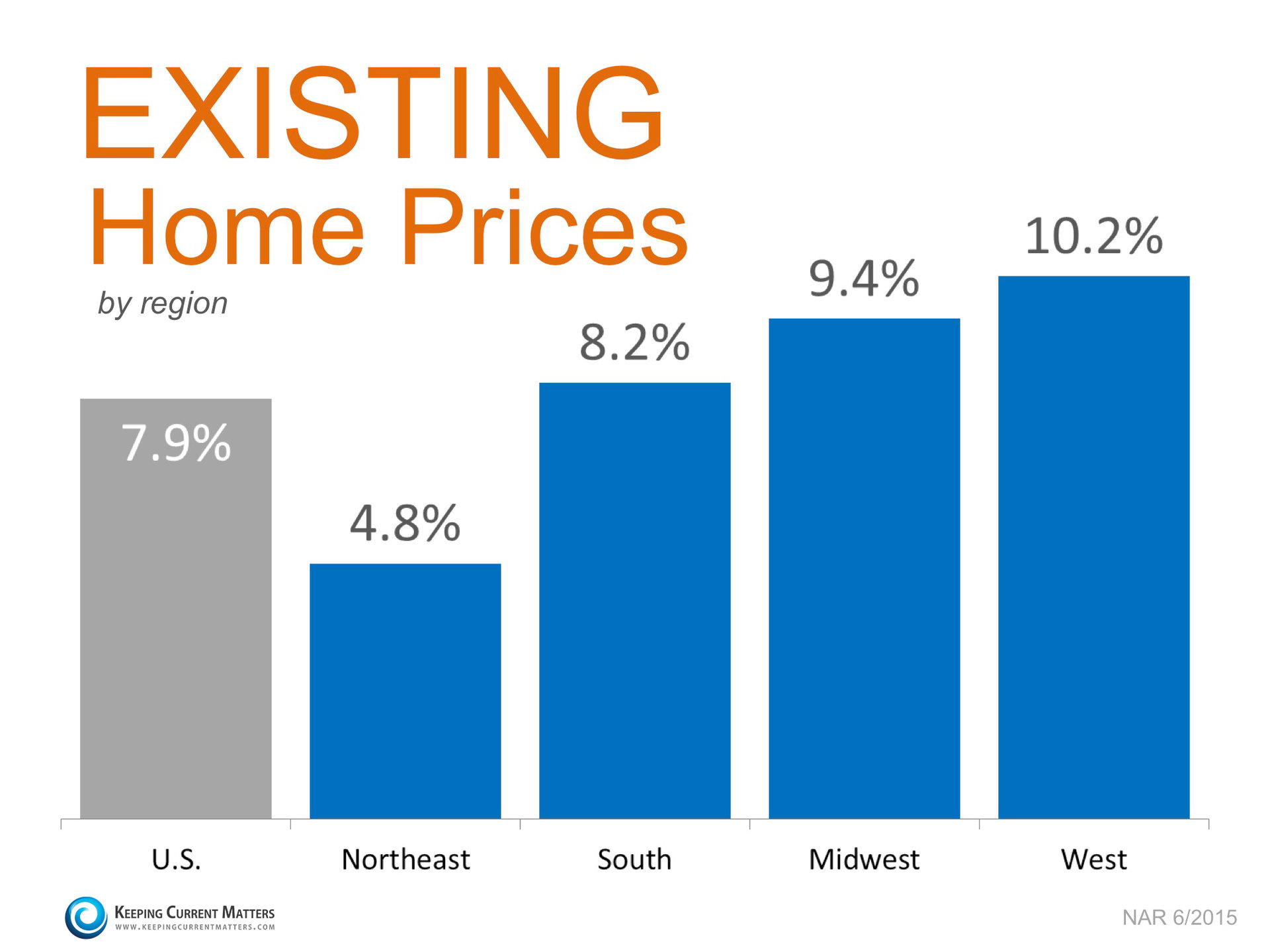

The National Association of Realtors’ (NAR) latest

The National Association of Realtors’ (NAR) latest

The Federal Reserve Bank of New York recently released the

The Federal Reserve Bank of New York recently released the

4816 Sawyer Ave Carpinteria, CA | Offered at $655,000

4816 Sawyer Ave Carpinteria, CA | Offered at $655,000