Business of the Month: Ameriflex

KAT HITCHCOCK’S INTERVIEW WITH

BRETT WEICHBROD + MAX PHILLIPS from Ameriflex

How long have each of you been in the financial industry and how long at AmeriFlex?

Max- I have been in the financial services industry for over 12 years now and I have been with AmeriFlex for the entire 12 years. That makes me the longest tenured partner at AmeriFlex outside of the founder and president of the firm.

Brett- I have been in the industry for 17 years, having started my career at a company called Canterbury Consulting, and working my way up through a couple of other firms, the most recognizable being PIMCO, and made my way to AmeriFlex about two and a half years ago.

What services does AmeriFlex offer? Do you do more than just personal wealth management?

Max- I think the public’s perspective is that we manage assets, which is part of our role as wealth managers. What we are really here to do is to help individuals and families navigate a course through transitional events. Those transitional events could be retirement, sale of a business, sale of an investment property, divorce, and sadly death of a loved one.

Brett- We provide holistic financial planning and asset management services to individuals and families, but we also work with small business and institutional investors. Those organizations can include non-profits, corporate cash accounts, essentially any organization that has a fairly long-term perspective and has capital they want to grow above what a savings account can provide.

What is the common misconception about wealth management that you find most often here in Santa Barbara?

Max- I think the most common misconception is that we have a crystal ball. We have the ability to see into the future. That’s not just here in Santa Barbara I think that’s just what wealth management and advisors face in general. I believe what we typically deal with in Santa Barbara is we are here to sell our clients something. When in reality it is about the bigger picture – it’s about developing a relationship, trust and managing that process. It is ultimately our job to work with our clients in developing and monitoring their goals and objectives. And importantly, we align our interests with theirs.

Brett- Max hit it on the head. Everyone’s gut reaction is we are trying to sell something. Really, our goal and our success in town has been from working with clients on a long-term basis. People do not always realize the value in working with an advisor and employing strategies early on, to help reduce tax liabilities, plan for generational gifting, and to help make life decisions that can influence their financial wellbeing. These topics are discussed preemptively as part of the financial planning.

What makes AmeriFlex stand out from other wealth management firms in town?

Brett- I would say the team approach. That is what attracted me to the firm several years ago. We each have diverse backgrounds with unique skill sets, along with a firm structure, that allows us to support each other and serve our clients as a team, and I believe clients appreciate that. We have taken the competitiveness out of the equation.

Max- I would add to that we have a very collegial group in our office, if there’s a question about a unique situation or a specific client need, we don’t hesitate in seeking a second opinion from the team and other advisors in our office. They are more than willing to take time out of their day and help, I think that is what makes us very unique, we can go to each other and ask for help or for an opinion without having to worry about issues of an ulterior motive. At the end of the day we are working together to put our client’s best interests as the top priority.

Brett- We also coordinate with other professionals. A lot of our clients can be business owners or going through a transitional situation where they really need a coordinated effort with their estate attorney or their cpa, thats where we go above and beyond where other firms may only focus on managing assets.

Max– Don’t forget we also coordinate with our trusted real estate advisors

Kat- Always appreciated! 😄

Do you service clients from all over SB county or state wide or where do your clients come from?

Max- I would definitely say our niche market is SB county but as a result of the transitional event planning we find ourselves working with clients throughout California and in many states. We have also have been successful opening other offices with the same philosophical ideas that we have at our Santa Barbara corporate office, in cities like Westlake, Newport Beach, and even Scottsdale Arizona.

Who is your ideal client and how many clients do you take each year?

Brett – I would say we look at our growth at a firm level, and we have certainly been growing. As far as ideal clients, I love working with non-profit organizations that have long-term endowments. But I also enjoy the relationships of working with individuals and families that are trying to figure out a future retirement or are in retirement and are trying to structure their assets in a way that provides an income stream.

Max- I would add that every client situation is unique- if we were strictly to adhere to a minimum or certain asset level we would easily be excluding a lot of individuals who could use our services or will need our help in the future. It’s our view that if we close the door on them it wouldn’t make a lot of sense for us, it’s too small of a town to turn people away. However, we have to be cognizant of the resources our team can provide and not strain those resources or dilute the level of service to our existing clients by just bringing on everyone we come across. We have to be selective but as Brett mentioned we have our own different niches and we constantly have a communication in our office to see who is going to be a good fit for the relationship.

Brett- Importantly, we do NOT have a million-dollar minimum- which many of our competitors do. We are willing to talk to almost anyone and see if there is an opportunity to work with them.

Can you explain your client services philosophy on how you ensure each client receives personal and professional services?

Max- I would say everyone is different – to have a blanket set of services for an individual client doesn’t make a ton of sense as it could alienate individuals who actually need insight and assistance who don’t think they fit the bill. Philosophically services are going to depend on the client’s unique situation; where they are financially; and where they want to be; and the feasibility to achieve their financial goals. There’s going to be a little more attention to detail depending on where they are in their journey. Ultimately service is customized to our clients and their situation.

Brett- Two key services we provide as wealth managers, financial planning and actual asset management. Financial planning has to be custom. Each family and individual has a unique situation therefore it has to be custom. On the asset management side we are customizing a portfolio around the financial plan, it’s not an approach where we have five models and everyone falls into one of them. I think people appreciate the extra attention to detail.

What is your favorite part of what you do?

Max – We don’t have the same repetitive days, week after week. In all seriousness we get to work with great people to help them achieve their goals. The ability to shine light on how we are going to guide them through a particular transition is where I find satisfaction. It’s that “aha” moment that our clients achieve and having them be grateful for the time and effort we provide.

Brett- First, working with smart people, I think that’s important and motivating. And two, the appreciation clients show when you have worked with them for a while and made a difference in their lives.

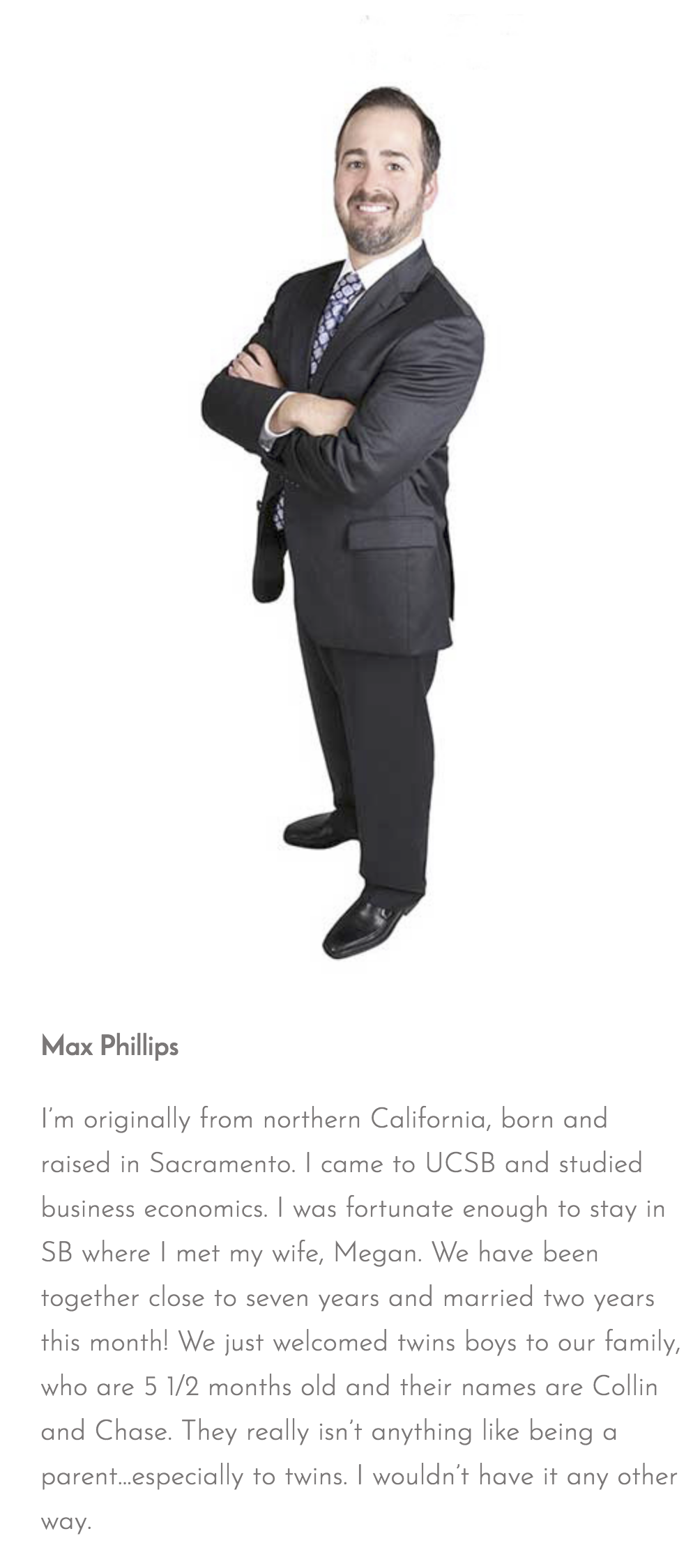

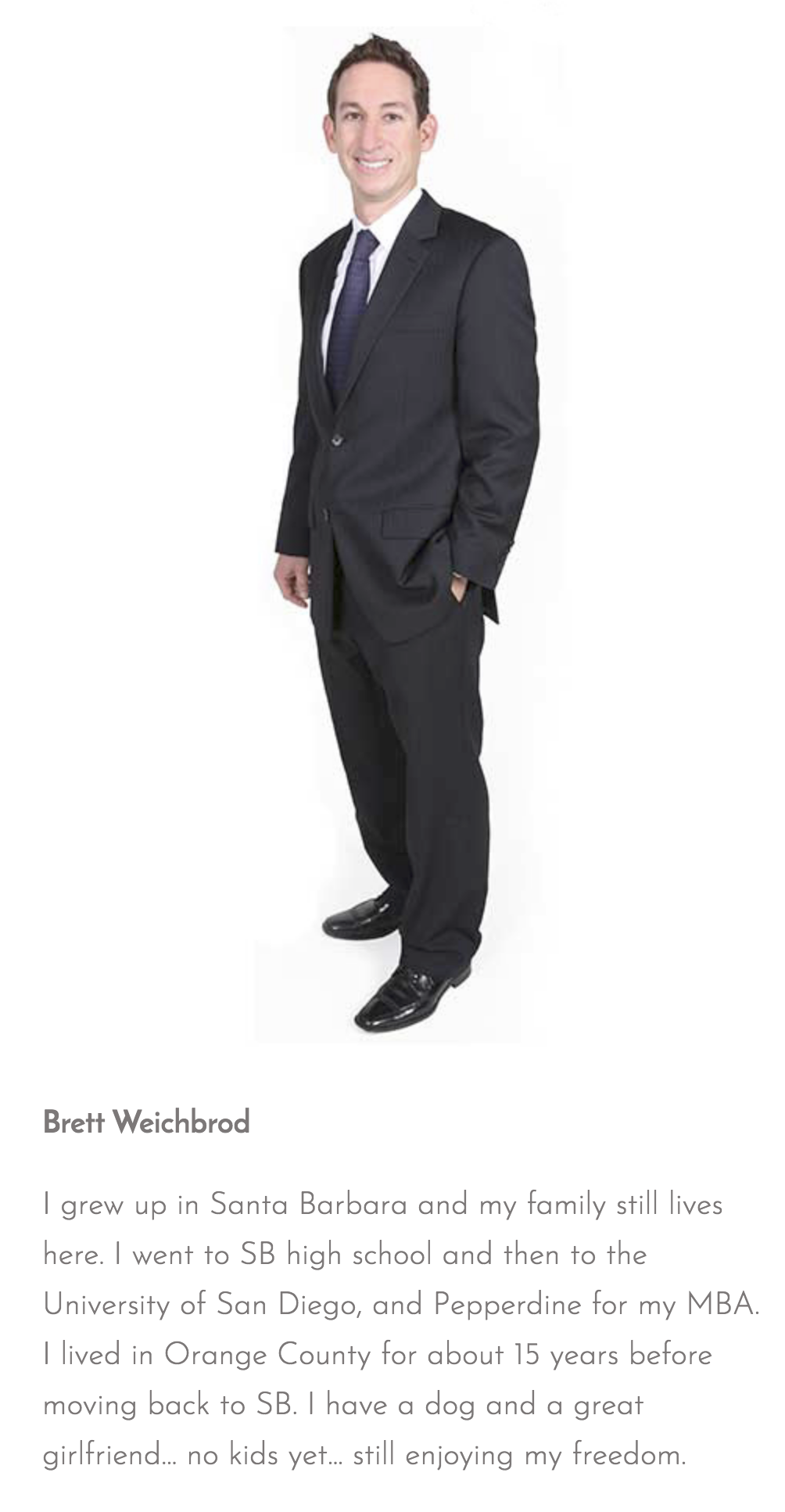

ABOUT EACH OF THEM